TEXAS, USA — Tuesday was Election Day in Texas with several state constitutional amendments and local propositions on the ballot, depending on where you live.

Voters made their voices heard on 14 amendments to the Texas constitution. We’re breaking down each proposition and showing the results of how you voted.

Proposition 1

"The constitutional amendment protecting the right to engage in farming, ranching, timber production, horticulture, and wildlife management."

The author of this prop is State Rep. DeWayne Burns, a Republican from Cleburne. He said as the Texas population continues to grow, the state needs to make sure farmers and ranchers can provide food without burdensome regulations from cities and counties.

It creates a constitutional right for Texans to farm and ranch, using "generally accepted" practices.

Some groups argued Prop 1 limits the ability of local governments to hold farmers and ranchers accountable and pass ordinances intended to protect public health interests, though there is a list of regulations city and county leaders can still pass ordinances on.

Proposition 2

“The constitutional amendment authorizing a local option exemption from ad valorem taxation by a county or municipality of all or part of the appraised value of real property used to operate a child-care facility.”

This proposition and the enabling legislation comes from State Sen. Royce West, who noted that from March 2020 until September 2021, 21% of child care providers in Texas closed, and now nearly half of all Texans – 48% – live in a child care desert.

Prop 2 allows counties and cities to lower property taxes for child care facilities if they participate in the Texas Workforce Commission's "Rising Star Program" and if at least 20% of the children enrolled receive subsidized child care services through the Workforce Commission. The intent is that by lowering overhead costs, more child care facilities can stay open or be built, and those savings can be passed along to staff and parents.

But some argued there's no guarantee that the savings will be passed on, and that lowering the tax base for one industry could raise it for others.

Prop 2 doesn't require cities and counties to offer a property tax exemption to child care facilities – it would just give them the option to do so.

Proposition 3

“The constitutional amendment prohibiting the imposition of an individual wealth or net worth tax, including a tax on the difference between the assets and liabilities of an individual or family.”

First, to be clear, Texas does not have, nor are lawmakers talking about creating a net worth tax. Earlier this year, a handful of states were considering it.

State Rep. Cole Hefner wants to ensure Texans won't have a net worth tax by banning them in the constitution.

What is a net worth tax? Lawmakers in a few other states have proposed taxing people if their net worth, which is their assets, or the things they own – think real estate, stocks, pensions – minus their liabilities, which is money they owe, equals a certain amount, generally a few million dollars.

Because this is not even on the table in Texas, some say there's no point in putting this in the constitution. Opponents of Prop 3 also say eliminating a potential tax could limit the options the state has to pay for things in the future.

Supporters say figuring out someone's net worth is complicated and could result in people being taxed when they actually don't have a lot of money on hand. Plus, Texas is a low-tax, business-friendly state and supporters want to keep it that way.

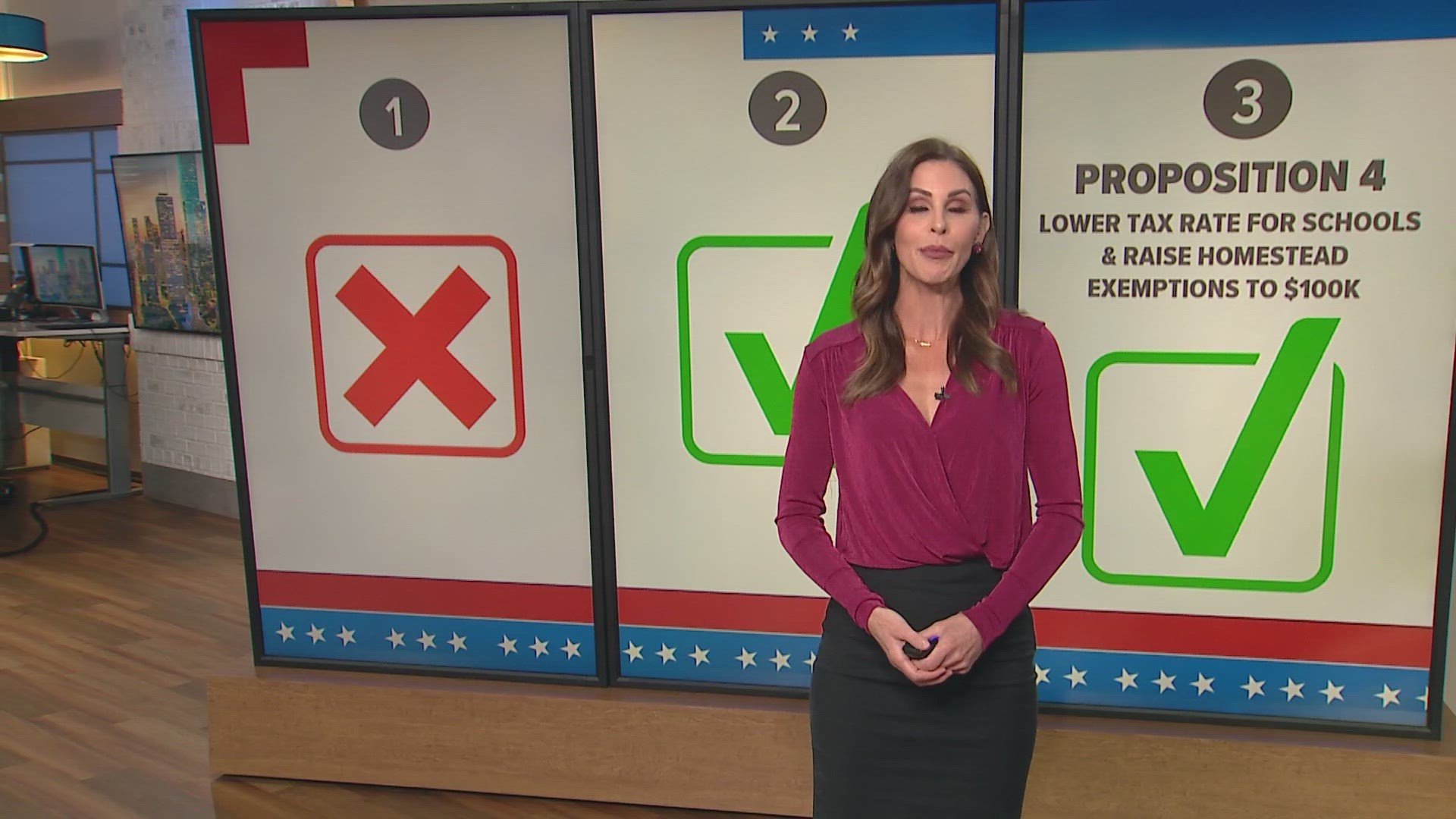

Proposition 4

This may be the most significant, and certainly the most talked about, proposition on the ballot. This is the $18 billion property tax cut lawmakers talked so much about earlier this year.

The ballot language is long, so let's just dive into what all five sections of the proposition mean.

The first part is the temporary limit on appraisal values of non-homestead properties. For three years, the taxable value of all property that is not someone's place of residence can not increase by 20% as long as the property is valued at $5 million or less.

The second part is the biggest part, as it would increase the homestead exemption on school district taxes from $40,000 to $100,000. It is estimated to save the average homeowner around $1,200 per year and eliminate school M&O taxes for some homeowners in nearly 400 school districts across the state, as their home values are at $100,000 or less.

The third part regards seniors and the disabled, ensuring that they benefit from the tax cut. In May 2022, voters approved a tax cut for the elderly and disabled, but some people didn't receive any savings because of how the law was written. This part would correct that error and make sure seniors benefit from the increased homestead exemption.

The fourth part deals with tax rate compression. To pay for the $18 billion proposal, the state has to spend more money on schools. However, the Texas Constitution limits the amount of money the Legislature can spend each session. This would allow the Legislature to pay for the tax relief without it counting toward the spending cap.

The last part expands the appraisal district board of directors in large counties. Counties with a population greater than 75,000 people would be able to elect three members of the board who will work with five appointed members. The elected members would serve four-year terms.

The provisions in Proposition 4 are a package deal, meaning voters can't decide on which sections they support.

Homeowners will begin to see tax savings in their 2023 tax bill.

Proposition 5

"The constitutional amendment relating to the Texas University Fund, which provides funding to certain institutions of higher education to achieve national prominence as major research universities and drive the state economy."

In essence, Proposition 5 deals with research grants.

Back in 2009, Texas lawmakers created the National University Research Fund to help state research institutions gain national recognition, which in turn helps the Texas economy.

This proposition renames the fund to the "Texas University Fund," and make sure it has a funding source. The source would be the interest income, dividends and investment earnings from the Economic Stabilization Fund, also known as the Rainy Day Fund.

With a limit of $100 million per year, the State would also put in a one-time $3.5 billion investment to kickstart the new fund.

It is worth noting that universities in the University of Texas and Texas A&M Systems would not be eligible for the fund. The new funding would only be available to Texas State University, the University of North Texas, Texas Tech University and the University of Houston, for now.

Propositions 6, 7 and 8

Three of the propositions – 6, 7 and 8 – would create new infrastructure funds in the state.

Prop 6: “The constitutional amendment creating the Texas water fund to assist in financing water projects in this state.”

As the population of Texas grows, so does the need for more water. Right now, the Texas Water Development Board estimates the state loses 136 billion gallons of water a year because of leaky pipes. A recent study found that's enough water to supply the cities of Austin, Fort Worth, El Paso, Laredo and Lubbock for an entire year.

Prop 6 would create a fund, outside of the General Revenue Fund, that will be used for grants and low interest loans for water projects. Opponents point out this would divert money from other state needs to pay for local water projects.

Prop 7: “The constitutional amendment providing for the creation of the Texas energy fund to support the construction, maintenance, modernization, and operation of electric generating facilities.”

This proposition is in response to the 2021 winter storm that left more than 240 people dead and millions of Texans without power for days.

Similar to Prop 6, Prop 7 would create a fund outside of the General Revenue Fund. That money would be used to give out completion bonuses plus zero-interest and low-interest loans for dispatchable energy projects.

The Legislature already set aside $5 billion for the fund in the budget, but voters have to approve the state spending that money.

Opponents point out this funding would mostly go toward building more gas-powered electric plants. In fact, wind and solar plants can't get loans from this fund. So, there are environmentalists who would rather see the state investing in renewable energy.

Prop 8: "The constitutional amendment creating the broadband infrastructure fund to expand high-speed broadband access and assist in the financing of connectivity projects."

It is estimated about 7 million Texans don't have access to broadband internet. Prop 8 would create a special fund that lasts until 2035 to build out broadband infrastructure.

The Legislature already set aside $1.5 billion for the fund in the budget, but voters have to approve the state spending that money.

Some point out that $1.5 billion is not going to be enough money to meet the needs of Texans. In fact, the lawmaker who wrote the bill asked for $5 billion.

Proposition 9

Proposition 9 on the November ballot will help retired teachers' monthly pay by giving those in the Teacher Retirement System cost-of-living adjustments.

Retired teachers have not received a cost-of-living adjustment, or COLA, since 2013. Even then, only teachers who retired by August 2004 got it.

Prop 9 authorizes a one-time COLA between 2 and 6%, depending on when the teacher retired. Lawmakers also passed a bill to give retired teachers between 70 and 75 years old a one-time supplemental payment.

The money is already set aside for the COLA in the budget, but it still needs voter approval.

Proposition 10

"The constitutional amendment to authorize the legislature to exempt from ad valorem taxation equipment or inventory held by a manufacturer of medical or biomedical products to protect the Texas healthcare network and strengthen our medical supply chain."

In Texas, medical and biomedical businesses have to pay property taxes on equipment and inventory, things such as PPE, medical devices and pharmaceuticals.

Proposition 10 would essentially allow biomedical companies to be exempt from the business property tax. The idea behind the proposition is to encourage more biomedical companies to come to Texas and strengthen the state's health care network.

However, given that these businesses would be paying less in property taxes, less money would be available for local governments and schools. The Legislative Budget Board estimates that the Foundation School Program, which is the primary source of funding for Texas schools, would lose around $43 million in the 2025 fiscal year and up to $60 million by 2028.

Propositions 11 and 12

Proposition 11: "The constitutional amendment authorizing the legislature to permit conservation and reclamation districts in El Paso County to issue bonds supported by ad valorem taxes to fund the development and maintenance of parks and recreational facilities."

Back in 2003, Texas voters approved a proposition to allow 11 conservation and reclamation districts (MUDs and WCIDSs) to issue bonds to develop and maintain parks and recreation facilities.

El Paso County was not one of the counties involved, and Proposition 11 would add it to the list. Granted, the bond would still have to be approved by El Paso County voters.

Proposition 12: "The constitutional amendment providing for the abolition of the office of county treasurer in Galveston County."

This one's simple and straightforward: it would allow Galveston County to eliminate the county treasurer position.

In 2022, voters in Galveston County overwhelmingly voted to eliminate the position, going as far as to elect Hank Dugie to the position. Dugie himself has promised to eliminate the position, going so far as to forego his salary as the county's treasurer.

The proposition could save as much as $450,000 a year by consolidating the treasurer's duties into other roles, but to get rid of the position, voters have to approve an amendment to the state constitution. If passed, Galveston would be the 10th county in Texas to do away with the position.

Propositions 13 and 14

Proposition 13 would increase the mandatory age of retirement for state justices and judges.

The Texas Constitution currently requires justices and judges of appellate, district and criminal courts to retire at the end of their elected terms when they become 75 years old. There's also a provision that requires a judge who turns 75 within the first four years of a six-year term to retire by New Year's Eve of the fourth year.

Proposition 13 would raise the retirement age of judges from 75 to 79 years old and abolish the Dec. 31 provision.

Proposition 14 would provide for the creation of the centennial parks conservation fund to be used for the creation and improvement of state parks.

This proposition emanates from a story that originated in Dallas, where a company called Vistra Energy leased Fairfield Lake Park to the state for free to be used as a park.

When Vistra Energy decided to sell the land, they initially offered it to the state, in which Texas Parks and Wildlife leaders said they didn't have the money. This led the company to sell the land to a developer who planned to close the park and instead build homes.

As it stands, the park is still a park since the county invoked eminent domain, but lawmakers want to create a fund that would allow Parks and Wildlife to buy new land and improve existing parks. Lawmakers have already sequestered $1 billion from the budget surplus to go into the fund if voters approve.