HOUSTON — A new tool is being set up to help Houstonians buy a home as housing affordability remains a challenge.

The median price for a home in the Houston area grew to about $338,000 in the last months of 2022, according to the Houston Association of Realtors.

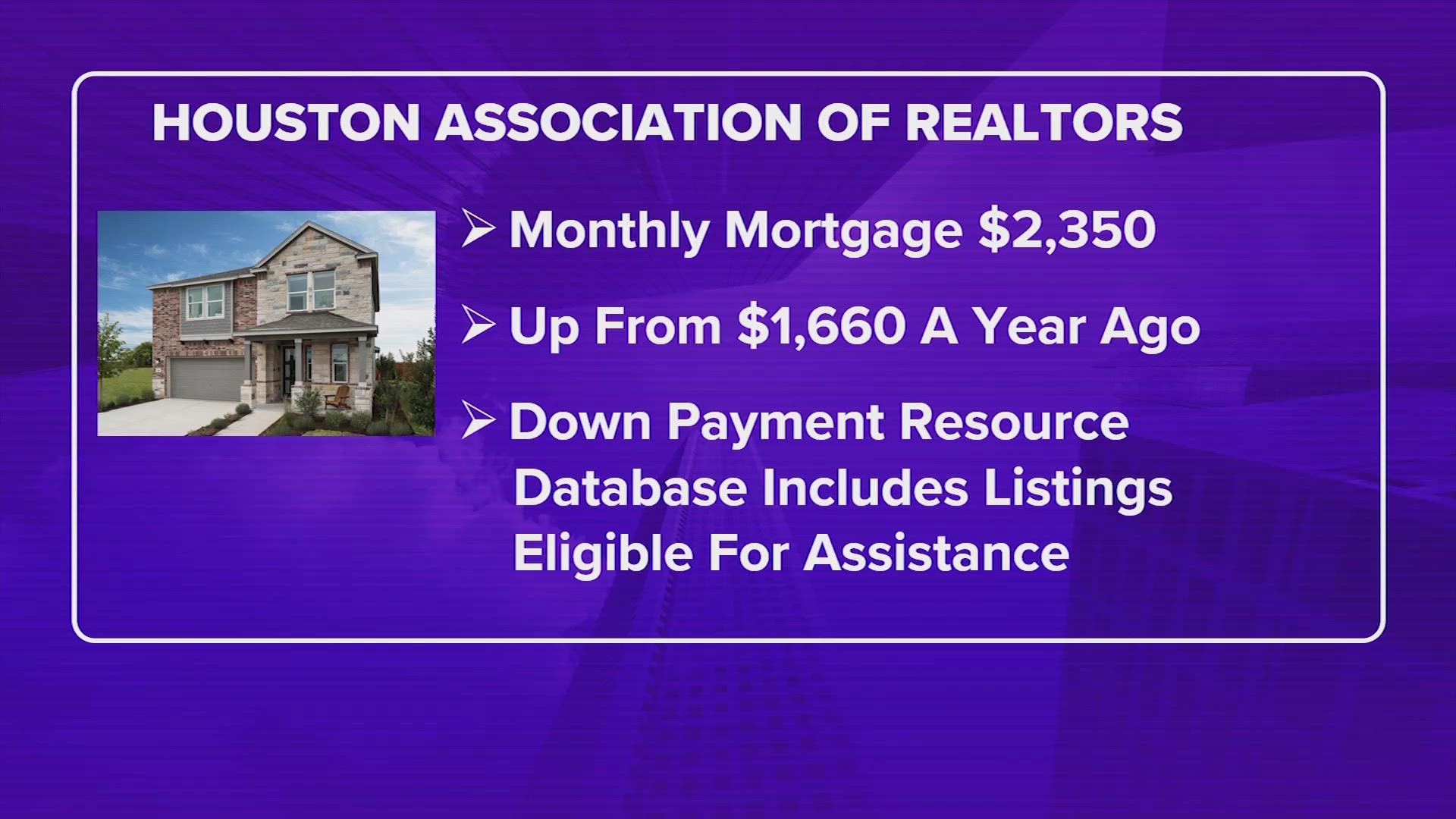

The monthly payments on homes are even a lot higher, mainly due to increased interest rates. The monthly mortgage on a 30-year, fixed-rate loan is now $2,300. That's up from $1,660 a year ago.

As a result, HAR is making homeownership more attainable by launching a downpayment resource database that will list downpayment assistance programs on more than 165,000 listings across Texas.

There are more than 2,000 homeownership programs available across the country that are funded at the local, state and national levels. There are additional incentives for veterans, active military, law enforcement, firefighters, healthcare workers and educators.

You can search HAR's website by address or neighborhood to find programs that are available in a particular area.

2023 housing market

It was a wild ride for the U.S. housing market last year. So what’s in store for 2023?

"Next 12, 18, 24 months in housing is going to be, it's going to be difficult,“ Chief Economist Mark Zandi from Moody’s Analytics told CNN back in January. "House prices rose very strongly during much of the pandemic, and we're just retracing some of those price gains."

If you remember, last year mortgage rates doubled, sales plummeted and many would-be buyers and sellers were sidelined.

In recent months, home prices have cooled from their blockbuster gains that happened between the Spring of 2020 and 2022. Back then, home prices rose nearly 40%.

Zandi said the market will be determined by inventory, the broader economy, and mortgage rates.

According to Freddie Mac, the 30-year fixed rate mortgage averaged 6.33% in the week ending Jan. 12, 2023. That’s down from 7.08% last fall, but well above 3.45% from a year ago.

The CEO of Rocket Mortgage, Jay Farner, said relatively high mortgage rates have caused homeowners to reconsider selling their homes. That’s leading to higher competition for fewer houses on the market.