THE TEXAS TRIBUNE – Showing their usual united front, the state’s “Big Three” political leaders on Friday tried to remake their case for why the Texas Legislature should deliver on long-term, ongoing property tax relief before the session wraps up this month.

They also expressed confidence that they would get the work done — even as House Democrats said they appeared to have the votes to block the lower chamber’s current main vehicle to provide the biggest property tax cut.

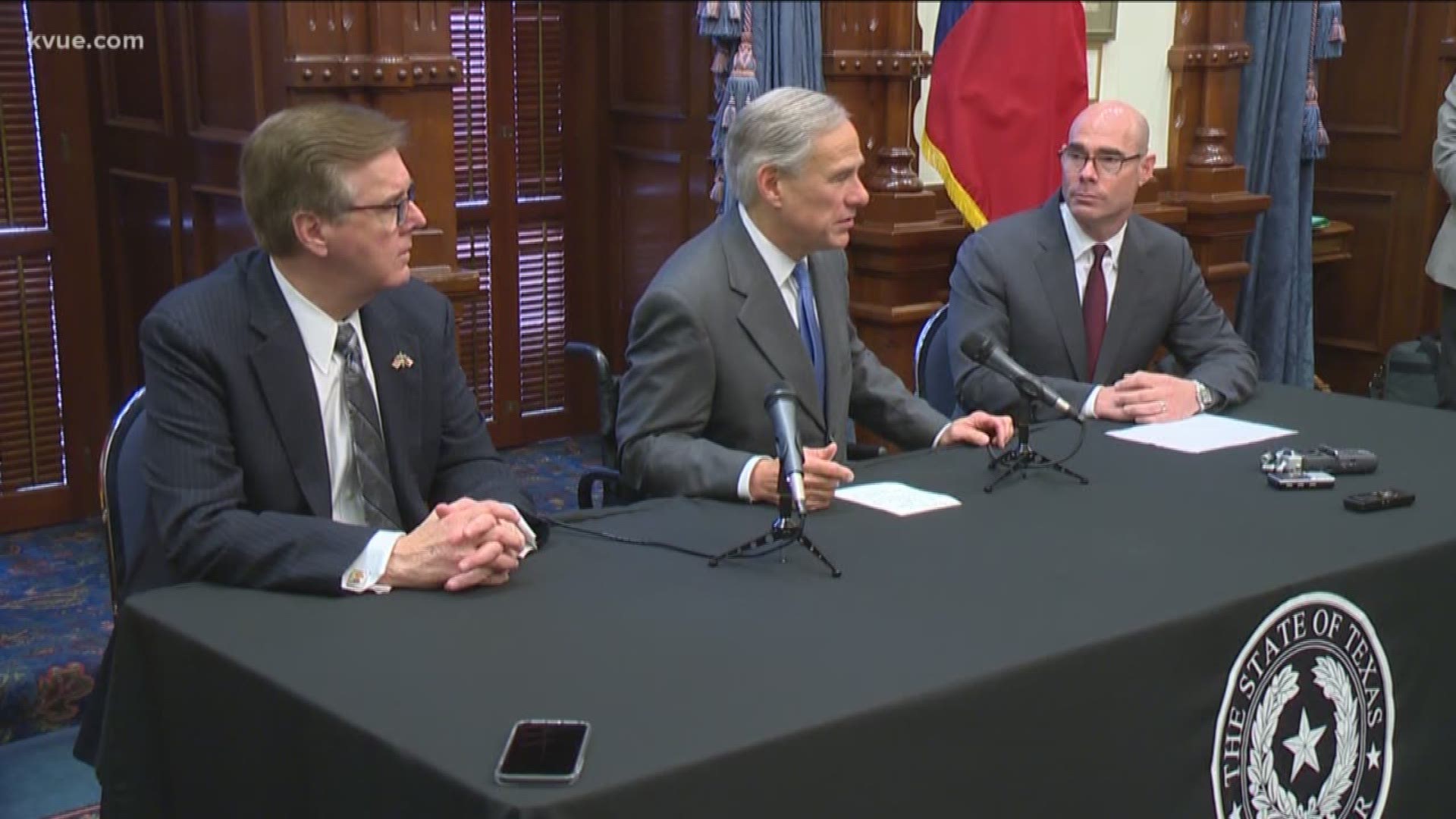

“Our goal is really simple: We’re going beyond the point of hoping to reform property taxes to the point where we’re hoping to to deliver true property tax relief through property tax reductions,” Gov. Greg Abbott said at a Capitol press conference Friday afternoon, flanked by Lt. Gov. Dan Patrick and House Speaker Dennis Bonnen, the Republican leaders of the Senate and House, respectively.

The three reaffirmed their commitment to a proposal that would increase the state sales tax one percentage point, raising about $5 billion per year to lower school district tax rates — which many have seen as a long shot from the start, with lawmakers from both parties skeptical about a sales tax hike.

The proposal has been moving through the Capitol so far in the form of a joint resolution, which needs two-thirds of each chamber to pass — at least 100 votes to pass the House and 21 votes to pass the Senate. If it passed both chambers, the proposal would then land on the November ballot for voters to decide, which leaders in support of the resolution have framed as a more democratic process.

House Joint Resolution 3 — which would ask voters to approve the sales tax swap for property tax relief — and its enabling legislation, House Bill 4621, passed out of the House Ways and Means Committee on Wednesday. The tax swap is expected to head to the lower chamber for a debate Tuesday.

The original version of the bill would have used 20% of the increased sales tax revenue to fund schools and 80% for property tax relief. That changed earlier this week, when state Rep. Dan Huberty, a Houston Republican who authored the legislation, tweaked the proposal to instead funnel all new sales tax dollars into property tax relief.

The move seemed to be an effort to bring on some of the Legislature’s more conservative members who had signaled they could be on board with a proposal if the new revenue was entirely dedicated to property tax relief. But it also seemed to solidify Democrats’ opposition to it, especially since the sales tax is regressive, meaning it takes a higher percentage of income from poorer people than richer people. A sales tax swap would raise taxes overall for Texas households earning less than $100,000 and would bring tax relief for households above $100,000.

State Rep. Chris Turner, who chairs his House Democratic Caucus, told The Texas Tribune that there are more than 60 “hard no” votes from Democrats against the proposal. If that opposition sticks for Tuesday’s expected vote on House Joint Resolution 3, its chances of passing the lower chamber would seem unlikely.

Patrick said he hoped both chambers would be able to get the needed two-thirds approval for the joint resolution from each chamber, but indicated he was open to getting it passed in different ways, exclaiming, “If it doesn’t, we’ll make it happen anyway!”

Lawmakers could instead seek a simple majority vote to raise the sales tax in state law, rather than in the constitution, and dedicate that money to property tax relief.

Since school districts levy the majority of property taxes, many Texans have been calling for lawmakers to find a permanent way to keep that portion of their tax bill steady. But that could be expensive: Unlike for cities and counties, the state is required to ensure school districts have money to meet the basic educational needs of their students.

If lawmakers choose to keep school districts from raising local tax revenue they’re entitled to, the state must fill in the gap. Currently, the sales tax swap is one of the only proposals moving through the Capitol that would raise money to reimburse school districts and provide ongoing relief from school taxes.

And, the three state leaders said, the swap would give most Texans visible decreases in their property tax bills.

“Why a penny? It’s simple for me,” Bonnen said. “Texans are sick of small ball. That penny will be noticeable. Texans want to open up a property tax bill and see that it is lower and they don’t have to squint to notice.”

The proposal has gained some prominent detractors, including state Sen. Paul Bettencourt, R-Houston, the upper chamber’s lead tax-writer. He said last week he has “great concerns” about using an increased sales tax to pay for lower property taxes, and he’s argued lawmakers could get even more money elsewhere.

Senate lawmakers have added a few provisions that would provide long-term property tax relief to their version of a school finance bill, which is set for a debate in the upper chamber Monday. But those provisions are contingent on either a sales tax swap or another source of ongoing revenue. Bettencourt was one of three in the Senate Education Committee who refused to take a vote on that bill this week, in part because the revenue source had not been identified.

Abbott said Friday that lawmakers were also looking for other revenue streams, including taxes from the extraction of oil and gas, to lower school district tax rates 15% to 20%. A working group in the Senate is considering some of those other strategies.

Friday’s press conference was also heavy on themes that the trio has worked hard to set this year — that, despite inevitable differences on the issues, they’re still collaborating in a professional fashion.

Bonnen recalled at one point during that he was stopped in the Senate recently by a person who told him that the “Big Three” were still eating breakfast together this late in the session.

“This is the first time in five years that the three leaders of the state had breakfast in the month of May,” he said with a chuckle. “And we’ll have breakfast for the rest of the month of May.”

Patrick, sharing his own take, said he thinks the Legislature is “at the 5-yard line” on property taxes. He added, “All we have to do is get the ball across the goal line.”

Texas Tribune mission statement:

The Texas Tribune is a nonprofit, nonpartisan media organization that informs Texans — and engages with them — about public policy, politics, government and statewide issues.

PEOPLE ARE ALSO READING: