HOUSTON — It’s that time of year to get your taxes turned in and it can be overwhelming, but there are several free resources available to help.

Inside BakerRipley’s building nestled in southwest Houston is an army of volunteers helping people, like Kavita Vunnam. with their taxes.

“It’s extremely convenient and very stress-free," Vunnam said.

She said it’s lifted such a big burden and she’s a repeat customer.

“This is my third time here and I’ve been very pleased every single time," Vannum said.

The non-profit has been running tax centers across Houston since 2009 and this year it is offering 27 locations.

“We understand that getting our taxes done correctly is so important for our neighbors," said Cristina Cave, Community Relations Sr. Manager with BakerRipley. "Especially for those that their refunds can mean anything from 20 to 30% of their annual income."

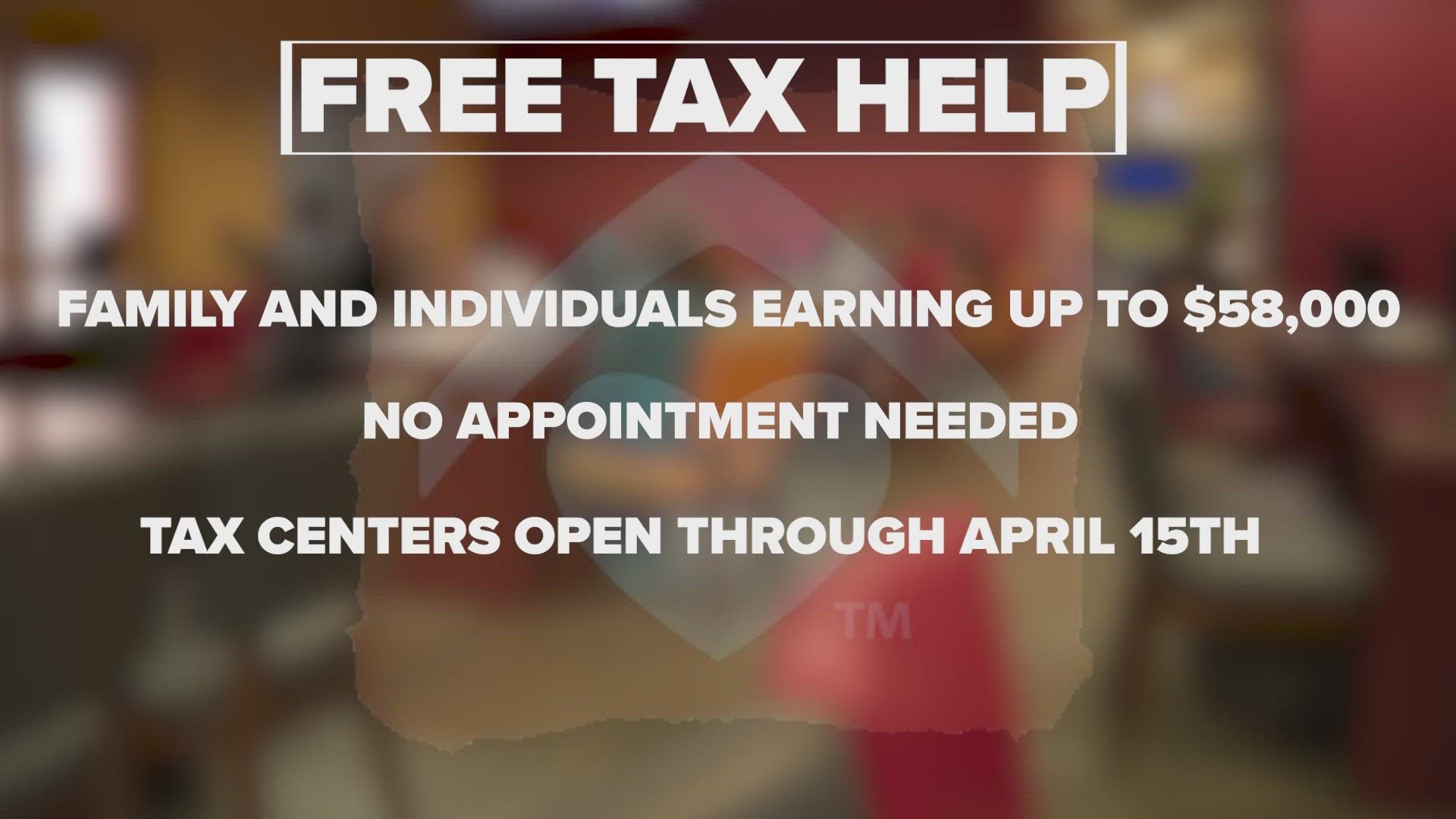

Family and individuals earning up to $58,000 per year are eligible. There are no appointments needed and tax centers will be open through April 15.

Vunnam said she was glad to get hers done before the deadline.

“Thank you so much for having this service. It means a lot to me," she said. "I’m sure it means a lot to many, many people because it’s not an easy time."

When getting your taxes done, make sure you have all your paperwork with you. If you don’t have everything you need, you could be asked to come back another time. They do offer the service virtually as well. You can find more information on BakerRipley's website.

The IRS is also offering a free filing service this year called Direct File. It is an online tool that can be used in 12 states, including Texas. It’s good for people who have a simple W-2 and claim a standard deduction. It's also available in Spanish.

If you have a problem and need help, email GraceCanHelp@khou.com, call (713) 521-HELP or fill out the form below.