AUSTIN, Texas —

Earlier this month, it was revealed that the Texas Workforce Commission (TWC) issued 46,651 notices of overpayment of unemployment benefits to Texans, which totals more than $32 million since March 20.

The more than 46,000 notices were a combination of mailed and online portal claims. On average, TWC overpaid about $700 per person, but those payments account for a little more than 1% of total claims filed.

While the overpayments were made by mistake, they will still need to be back. However, the TWC said payments don't need to be made right away:

Erica Proffer: “We’re going to focus on the overpayment bills. But before we get into that, give me the status update.”

Ed Serna, executive director, Texas Workforce Commission (TWC): “We’ve paid out over $17 billion so far and we've received about 3.7 million claims. We're paying about 2.7 million individuals on those 3.7 million claims. It's because people file duplicates and have error claims. That’s the reconciliation difference. We're paying out over $17 billion. Our call center staff, our own staff, I'm pleased to say, nobody has resigned. Nobody has quit. We still have our contractors on staff. When we started seeing our numbers go down, we started talking about, 'OK, here's how we'll scale back.' But we hadn't, fortunately. So when the numbers started going back up, we just kept them going. So we've got that going.

“Our system is working pretty good. We've changed our tactic a little bit in that we're not waiting for incoming calls. We've flipped the equivalent of a call center. I say the 'equivalent' because we didn’t take one whole call center. We took staff from each of our four call centers. We flipped it to make outbound calls because there are situations where we know people are trying to get us or we suspect someone has a problem. As an example, when we see someone that's filed a claim but they haven't submitted a payment request for several weeks, then we think either they got a job – yay – or they've got a problem. We can identify those individuals. We started calling them. 'Any reason you haven't haven't filed a claim yet?' 'I didn't think I needed to.' 'Yeah. Here's how the whole process works.'

“We've started outbound calls to the people that we can identify. We've also shifted a little bit of our attention to where we're trying to focus more on making sure that everybody's prepared for the next thing that's coming up, which is an unfortunate thing. That is the ending of the $600 unless Congress and the president do something. We're going to start some messaging that you'll see on our webpage and social media about the $600 coming to an end and how it all will affect individuals.

“The last time you can request any portion of that will probably be Aug. 8, because you always request for the two previous weeks, and how we only pay, by federal law, full weeks. So, technically, that very, very last week in July is not a full week. So, there won't be $600 for that.”

Proffer: “So, if somebody requests the first week in August – Aug. 6 or so – they'll get one week's worth of the $600 and then the following will be without it?”

Serna: "Yes, ma'am. That's why it's kind of confusing.

“We brief congressional Texas delegation every two weeks. One of the congresswomen was on the call saying that they were working to do something, that she recognized that unless that happened, it was coming to an end. We said, 'Yes, we just started messaging.' We're going to start messaging more heavily with this coming weekend and on social media pages, on our webpage, try to get information out through the media that this is coming, let people know that.

"We were very understanding early on and we still are understanding. We're concerned about it, too, with the $600 going away and the partial rollback, and then some municipalities or counties wanting to roll back further – the impact that would have. We're seeing larger employers that have kind of stuck it out as long as they could having to furlough portions of their staff. These are large employers. So, we're concerned about the impact of the economy overall."

Proffer: "On the overpayments and the collection, why now?"

Serna: "It's not kind of a ‘now’ thing. It always happens. The third quarter of 2019, we probably issued in excess of 20,000 overpayment. Except back then, if you were collecting money from us, we actually withheld it from your benefits. Fourth quarter was another 22,000, 23,000 in the first quarter of 2020.

"The four-month period March through the end of June is when we get a larger number of about 45,000. But keep in mind, that's on 2.7 million claims. So, it's not a 'now' thing.

"The one thing that is different now is we're not offsetting against any benefits that are being paid. So, if you got a letter from us that said, 'You received an overpayment. You owe this much back.' You're still going to get your benefits the next time you request payment, and we're going to continue to do that. We haven't turned on the offset.

"We don't claw back money. I will tell you, [another state] did that. They actually went into accounts and pulled money back. Well, then checks bounced. It was horrible. We can't imagine ever wanting to do that, ever doing that. We don't have the authority to do that if we want to, but we don't want to.

"The most you do is you get a letter from us that says you owe us money, and right now we don't even offset it against your benefits. There's no penalty and interest unless it's a case of fraud. Forgetting to tell us that you work some place is not fraud. Fraud is fraud. You got money you did not deserve at all, claiming that you were somebody else. In those cases and there's penalties and interest. The vast majority are claimant errors. It's someone who's failed to tell us that they received severance when they left, that they got a part-time job or that their employer kept paying them some money and didn't record the money that they were being paid. That's what triggered it."

Proffer: "Or if they were fired?"

Serna: "You may remember back in March and April, we were talking about, 'Well, there's this two-week delay and I thought you guys did away with the waiting week.' Well, we've done away with the waiting week, two weeks. We never did away with sending a notice to the employer saying, 'Did Ed, in fact, lose his job because of COVID?' We did have some employers that responded back saying, 'No. Ed just stopped coming to work,' or, 'No, we fired Ed.'

"One of the things that we did do, and this is where we caused about 3,000 of these overpayments so far, we sent that notice to employers and we didn't hear back. Instead of not paying people when they needed money, I told the UI division, 'Just pay them and we'll square up later. If, in fact, it wasn't because of COVID, we'll just catch it in the overpayment later. Let's get them the money that they need now to pay rent, utilities and buy food.' So about 3,000 or 4,000 of the cases are generated by what we're calling 'state errors.' That's the primary state error if we didn't hear back from the employer because even the employer was gone and we wanted to get benefits out to the individuals."

Proffer: "So in that case, they wouldn't have to pay anything back?"

Serna: "No, they still have to. Unfortunately, even if it's a state error, they shouldn't have received the money. We'll need to get it back.

"One thing that I'll share with you and the viewers is if the claimant failed to do something [except fraud], we're going send you a letter for overpayment. If you can, you pay us back, pay us what you can – $50 a month, $50 a week, you know, whatever. If you can't and you need to wait until you're back on your feet, we're not going to refer you to a collections agency. We're not going to claw money out of your account. We're not going to stop your benefits. We're not going to reduce your benefits. You just pay us back when you get on your feet. We will have the debt sit there.

"It doesn't ever go away and we will request a warrant hold at the comptroller's office. What that means is if you don't ever pay us back and never come back into the unemployment insurance system, but you get a job with the state or you are a contractor which does business with the state and the state owes you money, then you're your check won't be released until you resolve the debt with us.

"I'll give you a real-world example back in May. I received an email from an individual who was very dissatisfied because the comptroller's office had a check for her for some property that she sold to TxDOT. She was not receiving unemployment insurance, didn't need unemployment insurance. That's not why she was writing. She was writing to me because we had her check held up. So, I checked to make sure that it was valid. It was valid. Our folks contacted her. It turned out that back in the early 1990s, she had received unemployment insurance. She had an overpayment. She paid a portion of it and then she just stopped paying and ignored our letters. So that was the early 1990s and here it is in 2020, she's got a check coming from the state for something completely unrelated. It's hung up until she resolves this. It was not a very big amount, by the way, that she owed to us. She talked to our collections department. She resolved it, and we authorized the comptroller to release the check. They did. So, that's the worst that's going to happen unless it's fraud. If it's fraud, there's penalty, interest and other other things that we try to do to get that money, [like pressing charges]."

Proffer: "You guys send out these notices at the end of every quarter?"

Serna: "We send out the notices when we find that there's a situation of an overpayment. We have a dedicated group of people that look through all the claims just to make sure that everything is square with the claim. It's taking them a little bit longer because of the sheer volume. But we're on track to send them out."

Proffer: "Is this why we're starting to see a lot of people? It's because they weren't being sent out in March, April, May?"

Serna: "We're getting caught up on that again. We took all of that staff and shifted them to take calls. So, now we're doing that [prior] work again. We send out overpayment notices, just the volume right now in the middle of still dealing with the COVID emergency. So, it gets more attention."

Proffer: "Isn't it too early to shift everybody back? People are still trying to get through and they're having a hard time getting through, would those folks still be better utilized in the call centers?"

Serna: "Well, the contract call centers have gotten more expertise, more experience. They can handle more of the calls. Because they're handling more of the calls, we're able to take that one equivalent of one of our own call centers and shift it to outbound calls, we're able to free up some of the staff to do some of this other UI work. We haven't completely said, 'Go back and do your normal work.' It's all still related to this, but we let them go back and do this kind of thing that they need to do. Now, if if the spike continues to increase, then we'll start we'll take that outbound call center, flip it to inbound again. We'll take those people that are doing this kind of stuff, have them back receiving calls. We'll start bringing all those resources back in. But right now, we are in a pretty good spot because our contract call centers have gotten very proficient."

Proffer: "Is there a metric?"

Serna: "We don't have a hard number. The factors that we're looking at are the number of calls that are coming in. We're starting to see an increase, again of the number of calls that are coming in. And the wait times on the calls ... When we see the average beginning to inch up, and we are seeing it inch up, at some point we can say, 'OK, we need to flip everybody back in coming on.'"

Proffer: "How many people from the pandemic are getting these collection letters?"

Serna: "Unfortunately, we don't have any breakdown on whether they are receiving pandemic unemployment assistance or unemployment insurance. Everybody's receiving the $600. If you are ineligible for either the unemployment insurance or the pandemic unemployment assistance, you are ineligible for the $600.

"If your overpayment is, 'Hey, look, you were paid $400 and you really should have been paid $300, so you owe us $100, the $600 is unaffected. If you're eligible for one dollar of unemployment insurance you get the $600 ... The individuals that were overpaid for several weeks where they shouldn't have been qualified at all, that's when we need to recover both the benefit and the $600 because they didn't qualify for it."

Proffer: "Could you have waited until maybe everything had opened back up before saying, 'Hey, we need money from you?'"

Serna: "You know, we considered that. We've gotten [reminded] from the Department of Labor that we need to ensure the integrity of the system. Part of that integrity means not paying out money that isn't due to an individual ... Not knowing when this thing would end and not wanting to go any further, we just kind of followed our normal process with regard to the overpayment notice.

"The one thing we probably can do better is tell folks, 'Look, if you received a notice from us, it does mean that you owe us back, but you don't need to write us a check right now. You don't need to write us a check until you get back on your feet. If you can, that would be great. If you can't, we're not going to come after you.'

"Again, we're not going to claw any money back. We're not. There's no penalty and interest unless it was that small population that's tried to defraud us. There's no penalty and interest. Just pay us when you pay us. So, when you get back on your feet, you get stable, you get some money back in your savings account, then pay us back.

"We should have gotten that message out better, but we're obligated to not tell folks how to game our system. The feds don't like it when we do that. But I will tell folks and I'll take responsibility as the executive director, we'll tell our customers; 'If you get a letter from us, contact us. Acknowledge that you've got the letter, and just tell us what your plans are. Most of the time that's all we need – you telling us, 'Look, I'm going to pay you back. I just can't do it right now.'"

Proffer: "So, ignore that 'Your first $100 is due July 15?'"

Serna: "Yes. They are not offsetting overpayments against benefits."

Proffer: "People had commented on our Facebook talking about they got this notice, but their overpayment dates back to 2010. Another person, 2006, and 2002. They say that they just now get that notice."

Serna: "They probably received notices. I'd like to find out who they are so I can find out for a fact. There shouldn't be a flaw in the system."

Proffer: "I have asked them if I can share their information."

Serna: "We will work to resolve it. They may have forgotten. They may have ignored the notice. They may have moved and the notice went to an old address. At some point, we stop sending letters out. We don't ever refer to a collection agency. We don't robodial you at 8 p.m. saying that you owe us money. What we do is we wait until you're back in the system. We're not doing it right now and I can't emphasize that enough. Normally, what we do is when you come back into the system, we offset your overpayment against your current benefits. Since we're not doing that, and since we did shift people over to work on other things, we're getting caught up with everything. That's why they're getting those notices."

Proffer: "When will you start offsetting?"

Serna: "I'm not even going to speculate because we aren't going to offset until either we were forced to by the federal government or until we were forced to buy state leadership. We have a whole lot of support from state leadership. So don't believe that's going to happen. Our commissioners are supportive of our actions. So, the only thing that would happen is if the federal government, the Department of Labor, threatened our administrative funds, the funds that we run the program with by saying, 'If you don't do this, then we're going to cut these funds off.' Until this thing gets better, we're not going to be offsetting."

Proffer: "The notices that are going out right now, any of this in response to the Title XII advances that you guys have been getting or the amount of benefits you've been sending out? Are you trying to get some of that money back?"

Serna: "No, ma'am. It's sort of a regular trigger that occurs. It has nothing to do with the Title XII loans or with anything else. We have had some correspondence from the Department of Labor reminding us about protecting the integrity of the system and our responsibilities. This goes to all states, not just Texas. When we're on calls, we're reminded. We listen to them, and we do believe we protected the integrity of the system. For example, we still require people to check in every two weeks to request payment there. There are a couple of states that have just waived that. They're just paying you automatically. We still require you to request payment. We still send the notices to the employers saying, 'Was Ed really let go because of COVID-19 or no fault of his own?' We so we're still protecting the integrity of the system. We won't turn offset back on until we believe the economy is in a much better place or until we're forced to by the feds."

Proffer: "Part of the list of things that could trigger an overpayment is things like your work search, registering at WorkInTexas.com. Since those are waived right now., is that something that's going to come back and then bite people in the future?"

Serna: "No, ma'am. Registering WorkInTexas.com is something we encourage everybody to do anyway. But it doesn't cause it. It could in some point in the future and in the past, it could cause an impact of benefits. But it doesn't cause us to stop right now. Same thing with work search. So no."

Proffer: "You guys are part of the Treasury Offset program. Some of these collection notices, is there a reason why they haven't been deducted from people's taxes?"

Serna: "We suspended that as well. We suspended the Treasury Offset program during this emergency. Our commission took action to back in, I think it was late March, very early April. Our staff recommended that we suspend the Treasury Offset program.

"We're not really good at getting the word out on what we're doing, because that's a thing I think was helpful to individuals, too. So we're not offsetting against IRS tax refunds."

Proffer: "And you mentioned you're not charging interest, right?"

Serna: "Only on those cases of fraud. That's about 853 overpayments for this four-month period that are actually fraud cases. There's a penalty and interest on that."

Proffer: "Wow, is that higher than normal?"

Serna: "Third quarter of 2019 was about 550, fourth quarter 550, first quarter 592. The COVID period, which is March through the end of June, is 853.

"But then again, total initial claims during those same periods were 177,000+ for third quarter [2019], 191,000+ for fourth quarter, 687,000 for first quarter [2020], then 2.75 million [initial claims] during the COVID period. So percentage wise, it's a lower percent right now."

Proffer: "The Department of Labor tracks the root causes of overpayments. Right now, with the pandemic, do you know the root causes from most of these overpayments?"

Serna: "Most of the overpayments are claimant errors ... people simply failing to report income, people reporting an employment end date sooner than the actual employment end date."

Proffer: "One of the people on Facebook mentioned that her case dates back to 2002, 2003. But when she contacted TWC, they said that it's too old of a case to reopen. Yet she still owes it. Is that ever the case?"

Serna: "It doesn't sound right to me. It may be too old to appeal because there are limitations on when you can appeal things. Maybe that's what she's referring to by 'reopen.' But the debt itself, once it's established, doesn't ever expire.

"There are limitations to being able to open an appeal again once the three commissioners, not staff, once the commission decided a case. There is a certain period of time that you can appeal that in federal court. If you don't do that, then statute of limitations actually prevents any kind of a reopening of the case. But I'd have to look at the situation of the circumstances specifically."

Proffer: "How does the person get the notice of that?"

Serna: "Well, the appeal process, you know, starts with the very beginning, at the very beginning, where the individual submits their claim. We request information from the employer. The employer can either confirm or say, 'No that's not the case and he was fired or quit on his own.' The employer can trigger the appeal. That goes all the way through to our commissioners to be decided by our commission into a public meeting. Now, not all the cases are debated in public, but all the cases are reviewed by the commission offices and a decision is made in public. Once that's done, then there is a notification that goes out. All along the way there are notifications that go out to both parties that indicate what the rendered decision was. It gives both parties the time period for the opportunity to provide an appeal. Sometimes that frustrates the beneficiaries, because if we're not paying them benefits and they won an appeal, lower-level appeal, they have to wait the 14 days for the employer to appeal. If the employer doesn't, then we release the benefits. But in any case, once it's finally decided by the commission, then there are notifications that go out to both parties on the decision."

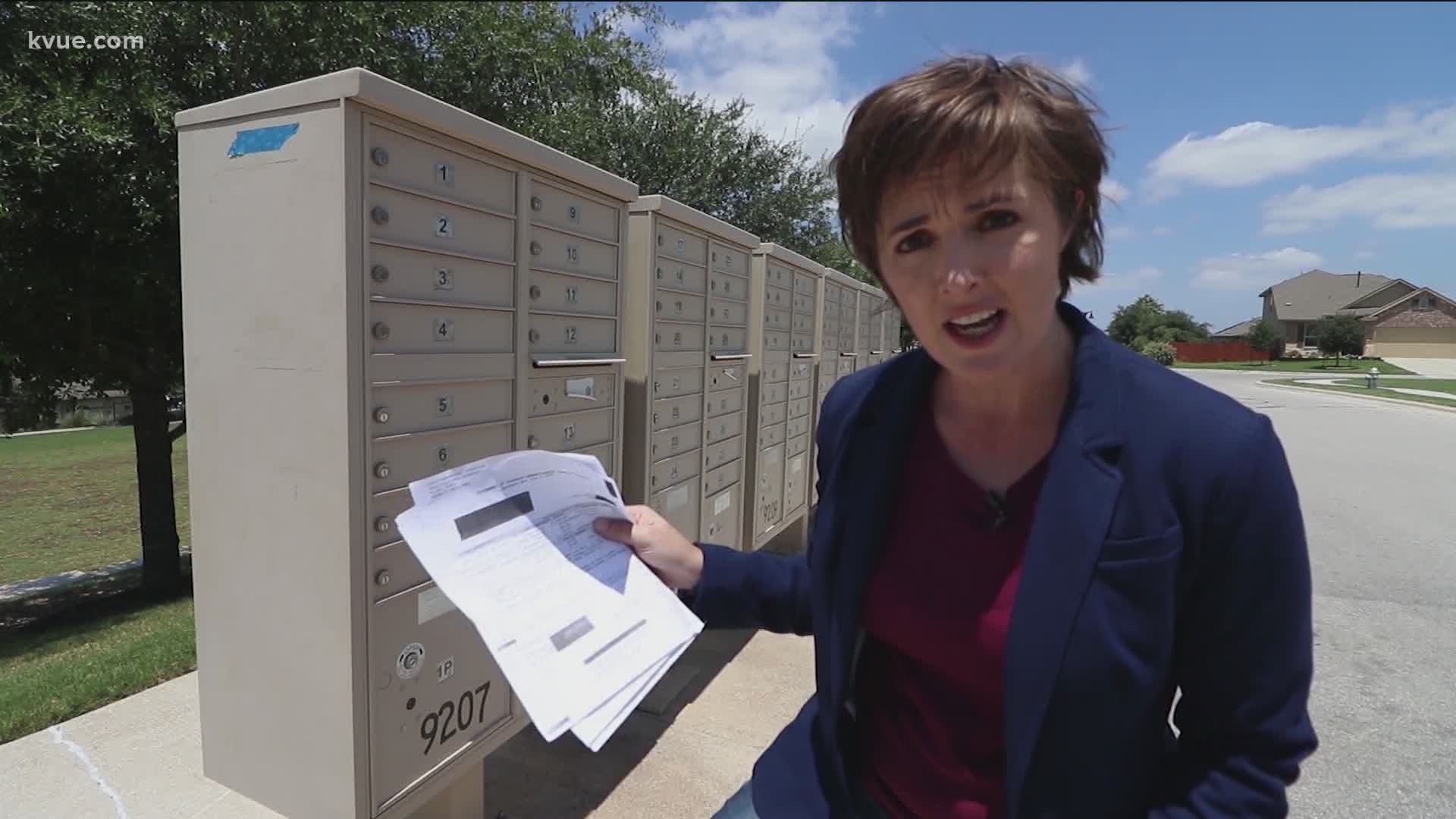

Proffer: "How are these notices sent out? Are they by mail, email or would somebody need to log into the [TWC Unemployment Benefit Center] portal?"

Serna: "No, they're mailed out. The decisions are mailed out. There may also be an email and there may also be a notification on the portal that they would have been mailed out."

Proffer: "What would you need to pause collections? Would that be a governor's order? Would that have to come from the Department of Labor?"

Serna: "Well, they have to pay. But there's no penalty for not paying. In my opinion, there's really not an action needed to pause collections. I know that the debt is never forgivable and that that's in the Texas Constitution. It's not a TWC rule or statute that governs TWC; it's actually in the [Texas] Constitution. In my opinion, there's really not an action needed to suspend collection because we're probably one of the best people to owe money to because we're not going to strong arm. If you committed fraud, it's a completely different side of TWC. There we are much more aggressive. We work with local district attorneys and law enforcement and federal law enforcement to recoup our money. But in these other cases, if you are still struggling, we understand. We will simply say pay us when you can."

Proffer: "I'm going to flip the script a little bit and talk on behalf of our fiscal conservative audience. This is tax money going to people who need it to be paying it back. If you guys aren't going to go after folks, do you have enough teeth to go after them?"

Serna: "The two tools that we have are the offset against future benefits and the [comptroller] warrant hold. It's different for businesses. There are penalties and interest and liens that we file. We have very aggressive collection action. For individuals, our strongest tools are the offset and the warrant hold and the fact that the debt never, ever, ever goes away. We're relatively a conservative agency. We're probably one of the few state agencies that runs like a business. So we recognize our revenues as revenues and collections as revenues as well. So for the conservative viewers, we do pursue these. We don't let them slide and go away. But at the same time, we understand when people can't pay us but do want to pay us and will pay us. That's why I also don't believe we need to be turning off the collection efforts while we still need to send out the overpayment notices. The timing may be bad, but we still need to pursue those things that we need to do and set these things up so that individuals can pay us back when they can."

Proffer: "If someone has an overpayment that's due and they went back to work, then something happened and they go back on unemployment, will the overpayments be deducted at that point?"

Serna: "Until we turn on the overpayment offset, it's off. So, individuals that owe us have gone back to work and unfortunately come back into the system, it's still turned off. When we turn it on, it's turned on for everybody. It's going to be unfortunate when it happens, because that means individuals that still don't have a job and are getting benefits from us, we would offset at that point. That's far down the road."

Proffer: "Is that something that it will take the commissioners to approve or is that something that you guys will be able to enact on your own?"

Serna: "We will do it in a public meeting. There are a lot of decisions that can be made at my level that we've decided to discuss and present to our commissioners in public meetings. So that one, the commissioners are aware of it publicly and to the public and the press are aware of it.

"When we turn offset back on, it'll be very similar to work search in that we will tell people. It'll be a commission discussion, and then we will tell people in advance. We'll tell them again and again and again until it's turned back on, same thing with work search."

Proffer: "Is there anything else, whether dealing with overpayments or anything else?"

Serna: "We need to warn viewers that there are going to be individuals that will contact them or they'll be Facebook pages or web pages that say, 'Hey, we can help you get out of your debt with TWC. If you contact us or if you pay us a smaller amount, we can take care of your debt. Just call this number.' They're going to get information from you that could end up, one, allowing them to duplicate your identity, but two, allowing them to then defraud us and have your payments diverted someplace else.

"There is no collection agency. Nobody else. We will assist you with this. This is one of those times please don't give in to the temptation of paying 10 cents on the dollar to get out of your overpayment here. There is nothing that will do that and you will still owe us. In addition to that happening, you will still owe us the overpayment.

"There is only one way to file for a claim, and that's through us. The same thing is true with overpayments. There's only one way to resolve it. That's working with us, and we are very cooperative.

"Interesting thing I will share with you and your viewers is we don't enter into payment agreements, but we will accept payments. There are restrictions to what we can do with regard to collecting the debt. So, we won't enter into a formal agreement with you to pay $50 a month or $50 a week. But you can pay us $50 a week and we'll take it and we'll reduce the debt accordingly."

Proffer: "So somebody gets a notice saying you owe $1,000, pay us $100 by whatever date, that's not necessarily a payment agreement? It's essentially a suggested amount?"

Serna: "Right."

Proffer: "On a suggested date?"

Serna: "Right, it's to kind of get you to contact us and then we can work with you. We will work with everybody that needs and is willing to work with us on getting this resolved. And I've said it before, but we're not big, strong arms in this."

Proffer: "Anything else?"

Serna: "Work search is suspended until we see how things get better. The same thing is true with benefit offset. The Title XII loans are working smoothly. Nobody's benefits have been affected nor will be affected. I believe the whole agency is still focused on unemployment insurance. As we begin to shift our attention to employment services, we'll have other information to share with you there. We're executing contracts with two large firms to provide training, skills training to individuals right now. Of course, it's no cost to the individuals. So, if someone while they're at home, they can take advantage of this and upskill their capabilities and maybe get a higher paying job or a different job or a better job than where they're at."

PEOPLE ARE ALSO READING: