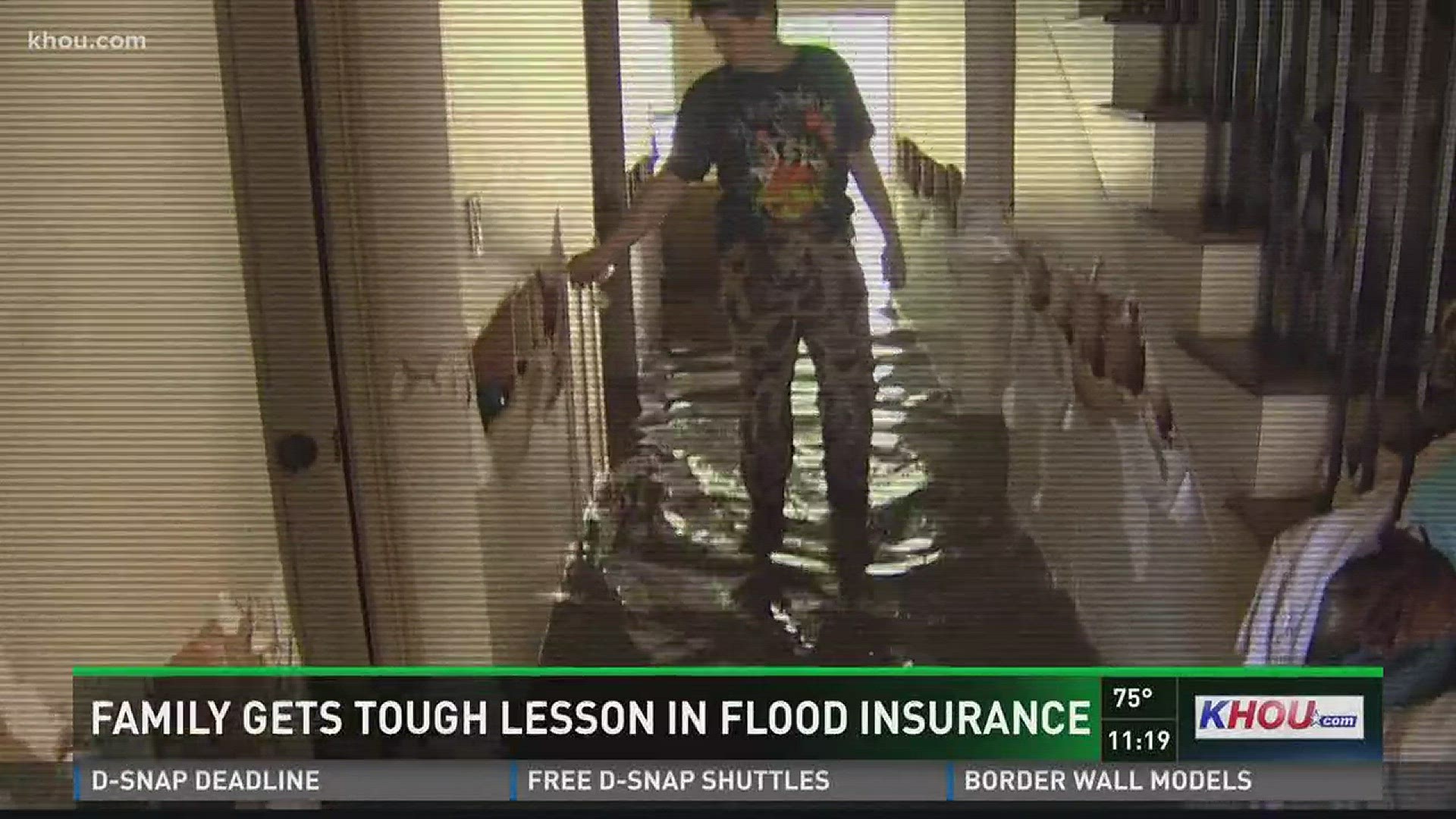

“We kept watching out the window and waiting,” recalled Kimberly Kant. “We thought for sure it’s going to flood.”

But the Kants of Magnolia were spared from Hurricane Harvey’s floodwaters.

Their fear comes from experience.

Umesh and Kimberly Kant moved into the home on Sapphire Circle near FM 1488 in March 2016.

They flooded twice in less than two months. The first time was during the Tax Day Floods in April 2016 and again in May.

Because they live in a high-risk flood area, the Kants were required to get flood insurance by their mortgage lender. The got the policy though their insurance agent as part of FEMA’s National Flood Insurance Program.

They filed claims and fixed up their home. They felt very blessed to avoid flooding again during Harvey.

“We were like, Wow, this is awesome!' and then we found out what our insurance premium is,” Kimberly Kant said.

Their premium went from $475 nearly $2,600 a year.

“We knew it would be more,” Umesh Kant said. “I was willing to pay double. When my insurance agent told us it’s going to be $2,600, I didn’t even know how to react.”

The National Flood Insurance Program subsidizes flood insurance into what’s called the Preferred Risk Program. However, when you file two claims totaling more than $1,000 each in a 10-year period, you’re no longer eligible for the program.The Kants are now required to buy a standard-rated policy which costs a lot more.

Jim Blackburn is an expert in environmental law and flooding along the Gulf Coast. He’s also a professor at Rice University. No matter the current charges, he strongly urges homeowners to get insurance even if it’s not required.

"It’s a bargain compared to pure actuarial rates,” Blackburn said. “The pure actuarial rates could easily rise to $20,000 a year. No one is paying anything close to that right now.”

For the Kants, their skyrocketing policy feels unfair and way too expensive.

“We owed that money back to the insurance company,” Umesh Kant said. “We will pay that money back but it has to be in a systematic way. We’ve become house poor now to figure out whether to pay the insurance back or we pay for him to go to school or college.”

FEMA is supposed to send a letter if your premium is going up. The Kants say they never got it.

In the end, the Kants managed to get their premium down to $1,600 by adjusting their coverage to exclude contents. They also found a different insurance agent and are hoping for better communication when prices go up and down.